Micro Equity for Digital Savings Groups

For millions of unbanked people, savings groups are an invaluable source of small business loans. While these informal community banks are highly successful, loan capital is self-generated from group savings, so members must wait until sufficient funds have accumulated before they can begin borrowing. To address this gap, we recently piloted a new “Micro Equity” investment product to give groups more capital to lend to members.

The way it works is simple: In agreement with the members, DreamStart Labs joins a digital savings group as an ordinary member, contributing a lump sum upfront and/or investing in each meeting like any other member. Unlike traditional loans, this investment stays with the group until the end of their cycle.

This additional capital increases the funds available so groups can start lending earlier... in higher amounts... and to more members. As an equity investment, we share the risk of losing all or part of our savings should the group fail. If the group completes its cycle and shares out earnings, we realize our portion of the profits like any other member. In short, if the group wins, we win. If it loses, we lose.

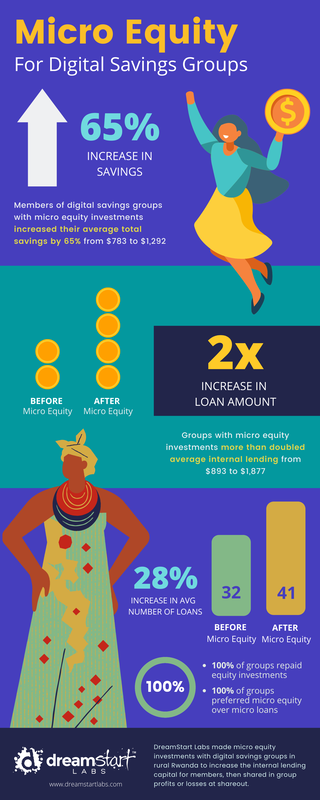

The results of our first pilot have been striking. Digital groups with Micro Equity investments increased their savings by 65% and more than doubled internal lending. At the end of the pilot, 100% of groups repaid their equity investment with profits, and all expressed a desire to take larger investments next cycle. Members also reported preferring Micro Equity to traditional micro-lending.

Read the full article on FinDev Gateway

NGO partners interested in piloting our new Micro Equity product with your groups can contact us at [email protected] for more details.

For millions of unbanked people, savings groups are an invaluable source of small business loans. While these informal community banks are highly successful, loan capital is self-generated from group savings, so members must wait until sufficient funds have accumulated before they can begin borrowing. To address this gap, we recently piloted a new “Micro Equity” investment product to give groups more capital to lend to members.

The way it works is simple: In agreement with the members, DreamStart Labs joins a digital savings group as an ordinary member, contributing a lump sum upfront and/or investing in each meeting like any other member. Unlike traditional loans, this investment stays with the group until the end of their cycle.

This additional capital increases the funds available so groups can start lending earlier... in higher amounts... and to more members. As an equity investment, we share the risk of losing all or part of our savings should the group fail. If the group completes its cycle and shares out earnings, we realize our portion of the profits like any other member. In short, if the group wins, we win. If it loses, we lose.

The results of our first pilot have been striking. Digital groups with Micro Equity investments increased their savings by 65% and more than doubled internal lending. At the end of the pilot, 100% of groups repaid their equity investment with profits, and all expressed a desire to take larger investments next cycle. Members also reported preferring Micro Equity to traditional micro-lending.

Read the full article on FinDev Gateway

NGO partners interested in piloting our new Micro Equity product with your groups can contact us at [email protected] for more details.